Written by Paul Whybrow

My first full day in Las Vegas and I took the long walk from my hotel to the very famous Welcome to Las Vegas sign. I did this not only so I can tell people I have stood by the world famous sign, but also so I can counter the typical Las Vegas conference lifestyle, of over indulging, with some small degree of exercise!

As the US broadcast industry gathers for the annual week of TV and radio innovation and product suppliers showcasing, more than 110,000 professionals will come to see what is new, meet up with global broadcast friends and do the annual health check of the US industry.

On the eve of the event, there are many experts pointing to a very unhealthy future not only for the broadcasters, but for the thousands of related businesses who flourish when TV and radio does, and who fear the near future, as viewing and listening switch to an on demand, mobile and digital future.

With two sources at hand I will share my top 10 signs of uncertainty and challenge, gathered from two reputable sources. First the NAB Industry Analysis created especially for the show and secondly my take outs from attending the Devoncroft Executive Summit.

So in no particular order here goes:

1- Consolidation and mergers are where the media creation and media product business are heading and yet evidence shows the share value impact is value growth that way underperforms the average.

2- The advertising industry has so many standards now for TV and digital that media players are struggling to deliver or measure correctly.

3- IT vendors say they are heavily invested in the industry however their dollar spend on marketing or events like NAB show the opposite.

4- Many broadcasters believe they have the process to measure efficiency gains, whereas in reality they have benchmarks that are simply not robust or consistent.

5- Financial CAPEX is shrinking although media technology spend is rising and there is a shift to OPEX.

6- Media companies are increasingly shifting to in-house product development to keep control, reducing spend externally.

7- Efficiency and agility are now strong business drivers for product purchases not just quality and fit for purpose.

8- Businesses are increasing the shift to supply chain approach for media content and so assessing vendors on ability to fit to the business owned supply chain.

9- Data is at the centre of everything and so solutions with best practices in place will be popular.

10- AI will be a crucial driver of future technology evolution in broadcasting and so R&D investment is key for vendors to make this work as broadcasters need.

For me, the most useful insights for product and service companies fearing how to tackle the new marketplace from the conference came from two CTO’s – “in a service world if you can rent it why would you buy it” and “suppliers just don’t understand how our business actually works and where we need help” .

I would suggest that in the coming year, there will be significantly more interest in understanding the pressures and goals that broadcasters face in getting investments signed off with suppliers. That is probably no bad thing in keeping everyone fit, flexible and healthy.

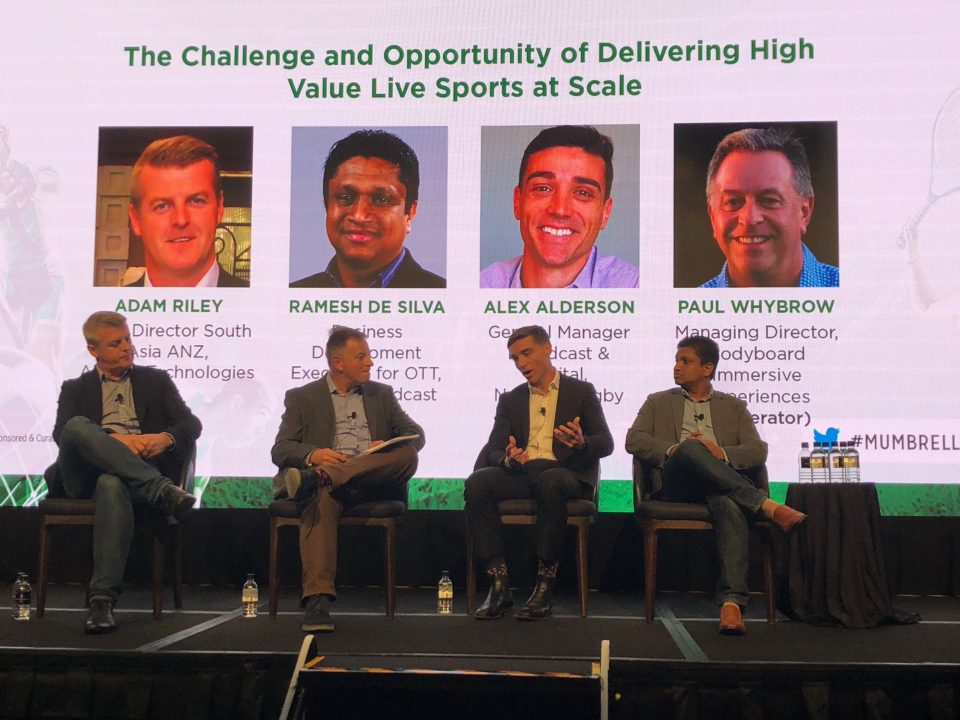

Paul Whybrow is the Managing Director and Creative Collaborator for Bodyboard Immersive Experiences – www.bodyboardie.com